Who applies to the Pennsylvania Sales Tax Permit?

Every person, association, fiduciary, partnership, corporation, or any legal entity which makes taxable sales of tangible personal property or services is bound to register for a Pennsylvania Sales Tax Permit.

What is the narrative of Pennsylvania sales tax?

Sales of personal tangible properties are contained leasing, renting, hotel, motel and any object which can be touched and felt is subject to sales tax and use in the state of Pennsylvania. It is collected from a Pennsylvania consumer on taxable items sale.

A complete list of the taxable and nontaxable items are published on the PA department of revenue website which is recommended to refer before charging sales tax on taxable goods and services from the state of Pennsylvania consumers.

A vendor who has a part or full nexus in the state of Pennsylvania is bound to charge sales tax.

Failure to be licensed may subject the seller to a fine. A business entity which makes taxable purchases and does not pay sales tax on taxable purchase is subject to pay use tax directly to the Pennsylvania department of revenue.

Currently the sales tax rate in the state of Pennsylvania is 6%, which is applied on gross receipts to compute sales tax.

How to pay Use Tax in Pennsylvania?

A use tax is applied in the state of Pennsylvania buyers who bought taxable goods from an out of state seller which are basically taxable in Pennsylvania.

It is an incorrect perception of the buyers that taxable goods which are bought from an out of state supplier is exempt or "Tax Free" from sales tax. A buyer is directly responsible to pay sales tax to its state revenue agency and a word "Use Tax" is used instead of a sales tax though it serves the same purpose.

What is the significance of use tax?

The use tax privilege was enacted by the revenue agencies to stop an unfair competition from the out of state vendors who advertise to buy tax free items which are subject to sales tax in the state of Pennsylvania. This sales slogan is simply applied to captivate buyers' attention.

It is subjected to pay penalty with the interest, if use tax was not paid on the items which were consumed in the state of Pennsylvania but originally bought from the out of state.

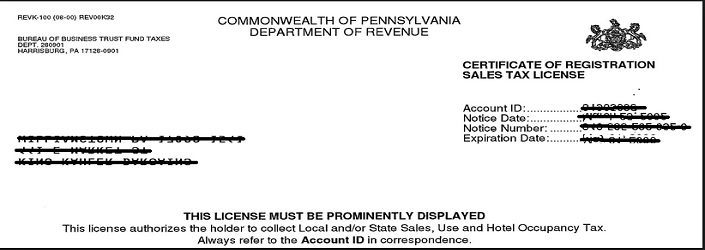

Pennsylvania Sales Tax License and Wholesaler's Certificate

Pennsylvania Department of Revenue issues both license where sales tax license is used to sell retail items and wholesale certificate is used to buy tax free purchases to resell end users.

How to apply for a Pennsylvania Sales Tax Registration?

Pennsylvania Sales Tax License is applied electronically at the Pennsylvania Department of Revenue Website by filling Form PA 100 and it is issued in 2-3 working days unless revenue agency need addition information.

Pennsylvania Sales Tax Filing Frequencies: Sales tax returns are filed electronically at the Pennsylvania department of revenue website generally on the following mentioned dates.

-

Monthly Sales Tax filers file Sale tax return on or before the 20th of the following month.

-

Quarterly Sales Tax Filers file sales tax returns every after three months on or before the 20th of the following month.

-

Semi Annually Sales Tax Filers file sales tax returns every after six months on or before the 20th of the following month.

-

If the due date falls on a holiday sales tax returns are filed next working day.

How to cancel reseller license/sales tax permit in Pennsylvania?

Sales tax permit Pennsylvania is given back to the PA department of revenue along with the final return and due taxes.

How does drop shipping taxed in the state of Pennsylvania?

A drop shipping is a modern way to sustain consumer, or "do not let the customer go" without buying. It is very effective and motivated means of sales, which converts sales effectively.

Described below the process of the entire drop shipping.

Initiate it with the sign up on different electronic commerce website, such as Amazon and eBay.

Subsequently find reliable suppliers in the niche to supply products on demand directly to the end users/buyers.

A vendor or an advertiser advertises on electronic commerce websites to bring potential customers on the online portal. It requires technical expertise in the digital marketing. It is highly recommended to acquire sufficient knowledge to drive relevant traffic on the web portal to keep the sales flow intact.

Send order information to the vendor to ship goods directly to the customer on the advertiser's behalf.

A vendor may need to apply seller permit in the state where the supplier is based to buy taxable goods without sales tax.

Drop shipping is a retail fulfillment method where a vendor does not see and store goods. The order is passed to a supplier upon getting orders to ship a buyer directly.

The person who delivers goods to a buyer is responsible to collect sales tax unless it is an out of state buyer which shifts burden of sales tax on a buyer's shoulder from a vendor to pay use tax to the department of revenue directly.